Mumbai:

Asset management co's new fund series, ASHA, will be raised in conjunction with Aadhar Housing Finance.

ArthVeda Fund Management, part of Dewan Housing Finance Corporation (DHFL), is raising ` . 2,000 crore through its new fund series `ASHA' to invest in affordable housing projects across the country . The fund is being raised in conjunction with Aadhar Housing Finance, a joint venture between International Finance Corporation and DHFL, Bikram Sen, CEO of ArthVeda, told ET.

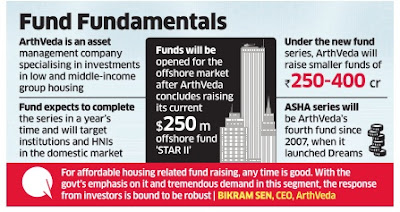

For now, the funds will be raised from investors in the domestic market and will be opened for the offshore market after ArthVeda concludes raising its current $250 million offshore fund `STAR II'. Under the new fund series, ArthVeda will raise smaller funds of . 250-400 crore.` “ASHA fund has been in the making for some time following the success of our affordable housing fund for middle-income households, STAR Fund,“ said Sen. “This is going to be an ongoing activity , and we will have around . 2,000 crore under management at any ` point in time after two years.“

ArthVeda is an asset management company specialising in investments in low and middle-income group housing. The fund expects to complete the series in a year's time and will target institutions and high net-worth individuals in the domestic market. ArthVeda has applied to the Securities and Exchange Board of India to change the current status of `ASHA Fund' to AIF category I from category II.

ArthVeda's fund raising follows the launch of three flagship government schemes for creating affordable housing stock and developing urban infrastructure.

“For affordable housing related fund raising, any time is good. With the government's emphasis on it and tremen dous demand in this segment, the response from investors is bound to be robust,“ Sen said.

ArthVeda is also working with some NGOs and social impact investors to design market-based solutions for strengthening low-income households, he said. The ASHA series will be ArthVeda's fourth fund since 2007, when it launched Dreams. In 2010, DHFL formed a joint venture with IFC (Washington) to create Aadhar Housing Finance (AHFL), a mortgage finance company exclusively for low-income households.

“Aadhar's field force and expertise in lending to low-income households, together with ArthVeda's expertise in managing investments in affordable housing, is a unique combination and creates a powerful channel to bring private equity into affordable housing.Initiatives like ASHA are in dire need, since the official figures of 2 crore affordable housing shortage is only understating the problem on the ground,“ said Deo Shankar Tripathi, CEO of Aadhar. ArthVeda expects to conclude receiving commitments for its STAR II fund by December.

No comments:

Post a Comment